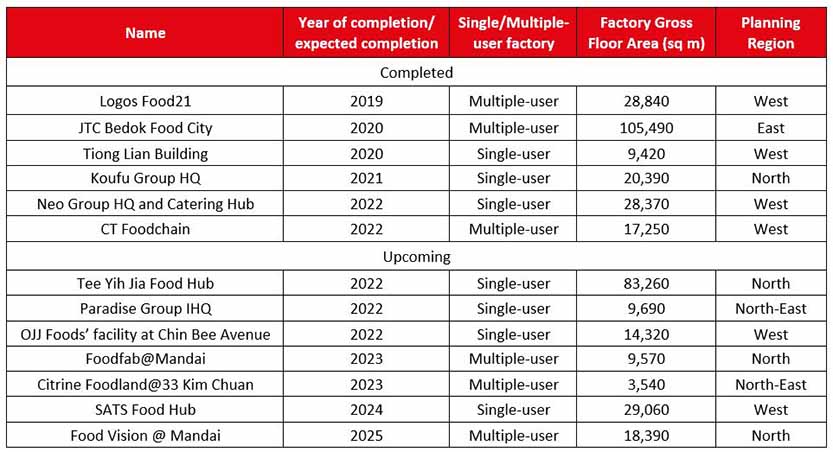

The food manufacturing and processing sector in Singapore has grown significantly in the last several years, which has increased demand for food industrial facilities. This article explores the main forces influencing this demand and offers predictions for Singapore’s food factory sector.

The Development of Singapore’s Food Industry: From 1,659 in 2019 to 1,847 by the end of 2021—a stunning 11.3% increase—Singapore has seen a notable surge in the number of licenced food production and processing enterprises, including central kitchens. The demand for food industrial facilities is driven by a number of reasons, which may be used to explain this significant development.

Shifts Caused by Pandemics

The COVID-19 pandemic that struck in 2020 and 2021 resulted in a substantial alteration in consumer behaviour. Central and cloud kitchens were established in response to the growing need for food delivery services during lockdowns. With nine locations around the island, providers like Smart City Kitchens increased their footprint and drew in well-known F&B companies like Jollibee and Poke Theory. The need for food manufacturing facilities increased as meal delivery services like GrabFood entered the cloud kitchen market.

A noteworthy milestone was the opening of FoodPlant, a shared food-tech space at JTC Food Hub @ Senoko, in April 2022. By 2026, it hopes to assist 200 food producers in Singapore in creating 400 new goods. The creation of bigger food production facilities for cutting-edge items might result from this project. Moreover, the updated Food Services ITM 2025 will keep serving as a catalyst for food innovation initiatives.

Governmental Initiatives

Launched in 2016, the Food Services Industry Transformation Map (ITM) was essential in helping multiple-location businesses automate their processes, cut down on labour, and realise economies of scale. Aiming for complete automation at their new headquarters, major firms like Koufu and the Neo Group combined their food manufacturing and logistical operations.

It is anticipated that shifting customer preferences about sustainability, wellbeing, convenience, and health will fuel the expansion of the ready-to-eat meal and alternative protein markets. Two of the best examples of businesses establishing alternative-protein production facilities inside of approved food hubs are Growthwell Foods and GOOD Meat.

Growing Market

Singapore is well positioned to take advantage of this potential, since food-related consumer expenditure in Asia is expected to treble to more than USD 8 trillion by 2030. The need for centrally situated food factories is further supported by Enterprise Singapore’s strong support of businesses growing into novel forms such as cloud kitchens and exporting retail food items.

There is a healthy and growing market for Singapore food factories. The thriving food factory environment is influenced by a number of factors, including government efforts, shifting consumer tastes, growing markets, and disruptions brought on by pandemics. The food manufacturing market in Singapore continues to be an important and active area of the country’s economy, even as the food industry in Singapore changes.